Bitcoin vs. Real Estate: Which Is the Better Investment? (2024 Comparison)

Introduction

Investors have long debated: Should you buy Bitcoin or real estate? Both are popular wealth-building assets, but they work very differently.

This 2,000+ word guide compares:

✅ Historical returns of Bitcoin vs. real estate

✅ Liquidity, risk, and volatility differences

✅ Passive income potential (rent vs. staking)

✅ Tax benefits & legal considerations

✅ Which is better for short-term vs. long-term growth?

By the end, you’ll know exactly where to put your money in 2024—and why some investors are choosing both.

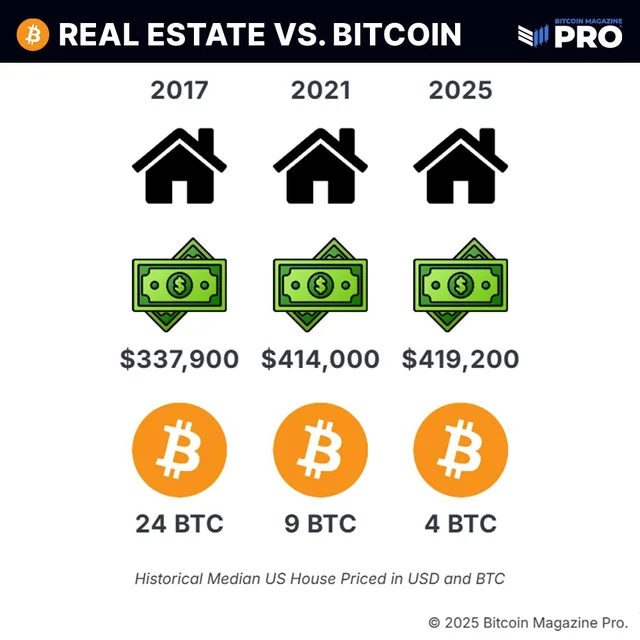

1. Historical Performance: Bitcoin vs. Real Estate

Bitcoin’s Returns (2009-2024)

- 2010: $0.0008 → 2021 ATH: $69,000 (8.6 million % gain)

- Even after crashes, Bitcoin has outperformed every asset class.

- Average annual return (10 years): ~200%

Real Estate Returns (U.S. Average)

- Last 30 years: ~4-6% yearly appreciation.

- Best markets (e.g., NYC, Miami): 7-10% yearly.

- Rental yield: 2-8% (depends on location).

📌 Key Insight: Bitcoin wins in growth, but real estate is stable.

2. Key Differences Between Bitcoin & Real Estate

| Factor | Bitcoin | Real Estate |

|---|---|---|

| Volatility | Extreme (50% drops common) | Stable (slow appreciation) |

| Liquidity | Sell instantly 24/7 | Takes months to sell |

| Passive Income | Staking (5% APY) | Rent (3-8% yield) |

| Maintenance | None | Repairs, taxes, tenants |

| Entry Cost | $10+ | $50,000+ (down payment) |

| Leverage | No (usually) | Yes (mortgages) |

💡 Takeaway: Bitcoin is easier & faster, real estate is tangible & leveraged.

3. Passive Income: Rental Properties vs. Bitcoin Staking

A. Real Estate (Rental Income)

✔️ Steady cash flow (if rented well)

✔️ Tax deductions (mortgage interest, repairs)

❌ Hassles: Bad tenants, repairs, vacancies

B. Bitcoin (Staking/Lending)

✔️ 5-10% APY (on platforms like BlockFi, Ledger)

✔️ Zero maintenance (no plumbing issues!)

❌ No physical asset (pure digital investment)

📈 Best for Passive Income?

- If you want hands-off: Bitcoin staking

- If you want tangible income: Real estate

4. Risk Comparison: Which Is Safer?

Bitcoin Risks

- Crashes 50-80% in bear markets

- Regulatory threats (bans, taxes)

- Hacking/security risks

Real Estate Risks

- Market crashes (2008 crisis)

- Bad tenants/lawsuits

- High transaction costs (6% agent fees, taxes)

🔐 Safety Winner?

- Short-term: Real estate (less volatile)

- Long-term: Bitcoin (higher upside)

5. Tax Benefits & Legal Considerations

Bitcoin Taxes

- Capital gains tax when selling (varies by country)

- No property tax

Real Estate Taxes

- Mortgage interest deductions (U.S.)

- Depreciation write-offs

- Property tax (1-3% yearly)

🏆 Tax Winner? Real estate (more deductions)

6. Which Is Better for You? (Decision Guide)

Choose Bitcoin If You:

✔️ Want explosive growth potential

✔️ Prefer liquid, 24/7 tradable assets

✔️ Don’t want maintenance hassles

Choose Real Estate If You:

✔️ Want stable cash flow & leverage

✔️ Like tangible, physical assets

✔️ Can handle long-term commitments

Smartest Strategy?

Many wealthy investors do both:

- Bitcoin for high-growth wealth building

- Real estate for stability & passive income

7. Future Outlook (2025-2030)

Bitcoin Prediction

- $100,000+ likely by 2025 (halving effect)

- Mass adoption as “digital gold”

Real Estate Prediction

- Slow 3-5% yearly growth (historically)

- AI & remote work changing demand

🚀 Growth Winner? Bitcoin (but real estate won’t disappear).

Conclusion: Should You Buy Bitcoin or Real Estate?

Final Verdict:

| Goal | Best Investment |

|---|---|

| Fast wealth growth | Bitcoin |

| Stable passive income | Real estate |

| Diversification | Both! |

💡 Pro Tip: If you’re under 40, lean Bitcoin. If retired, lean real estate.

FAQs

1. Can Bitcoin replace real estate?

- No, but it’s a better growth asset.

2. Is real estate safer than Bitcoin?

- Short-term, yes. Long-term, Bitcoin has higher upside.

3. How much Bitcoin should I buy vs. real estate?

- Young investors: 70% crypto, 30% real estate

- Pre-retirement: 30% crypto, 70% real estate

4. What if I can’t afford real estate?

- Start with Bitcoin (lower entry cost).

5. Which makes more millionaires?

- Recently, Bitcoin (but real estate still dominates wealth).

Ready to invest? The best time to start was yesterday—next best is today! 🚀Introduction

Investors have long debated: Should you buy Bitcoin or real estate? Both are popular wealth-building assets, but they work very differently.

This 2,000+ word guide compares:

✅ Historical returns of Bitcoin vs. real estate

✅ Liquidity, risk, and volatility differences

✅ Passive income potential (rent vs. staking)

✅ Tax benefits & legal considerations

✅ Which is better for short-term vs. long-term growth?

By the end, you’ll know exactly where to put your money in 2024—and why some investors are choosing both.

1. Historical Performance: Bitcoin vs. Real Estate

Bitcoin’s Returns (2009-2024)

- 2010: $0.0008 → 2021 ATH: $69,000 (8.6 million % gain)

- Even after crashes, Bitcoin has outperformed every asset class.

- Average annual return (10 years): ~200%

Real Estate Returns (U.S. Average)

- Last 30 years: ~4-6% yearly appreciation.

- Best markets (e.g., NYC, Miami): 7-10% yearly.

- Rental yield: 2-8% (depends on location).

📌 Key Insight: Bitcoin wins in growth, but real estate is stable.

2. Key Differences Between Bitcoin & Real Estate

| Factor | Bitcoin | Real Estate |

|---|---|---|

| Volatility | Extreme (50% drops common) | Stable (slow appreciation) |

| Liquidity | Sell instantly 24/7 | Takes months to sell |

| Passive Income | Staking (5% APY) | Rent (3-8% yield) |

| Maintenance | None | Repairs, taxes, tenants |

| Entry Cost | $10+ | $50,000+ (down payment) |

| Leverage | No (usually) | Yes (mortgages) |

💡 Takeaway: Bitcoin is easier & faster, real estate is tangible & leveraged.

3. Passive Income: Rental Properties vs. Bitcoin Staking

A. Real Estate (Rental Income)

✔️ Steady cash flow (if rented well)

✔️ Tax deductions (mortgage interest, repairs)

❌ Hassles: Bad tenants, repairs, vacancies

B. Bitcoin (Staking/Lending)

✔️ 5-10% APY (on platforms like BlockFi, Ledger)

✔️ Zero maintenance (no plumbing issues!)

❌ No physical asset (pure digital investment)

📈 Best for Passive Income?

- If you want hands-off: Bitcoin staking

- If you want tangible income: Real estate

4. Risk Comparison: Which Is Safer?

Bitcoin Risks

- Crashes 50-80% in bear markets

- Regulatory threats (bans, taxes)

- Hacking/security risks

Real Estate Risks

- Market crashes (2008 crisis)

- Bad tenants/lawsuits

- High transaction costs (6% agent fees, taxes)

🔐 Safety Winner?

- Short-term: Real estate (less volatile)

- Long-term: Bitcoin (higher upside)

5. Tax Benefits & Legal Considerations

Bitcoin Taxes

- Capital gains tax when selling (varies by country)

- No property tax

Real Estate Taxes

- Mortgage interest deductions (U.S.)

- Depreciation write-offs

- Property tax (1-3% yearly)

🏆 Tax Winner? Real estate (more deductions)

6. Which Is Better for You? (Decision Guide)

Choose Bitcoin If You:

✔️ Want explosive growth potential

✔️ Prefer liquid, 24/7 tradable assets

✔️ Don’t want maintenance hassles

Choose Real Estate If You:

✔️ Want stable cash flow & leverage

✔️ Like tangible, physical assets

✔️ Can handle long-term commitments

Smartest Strategy?

Many wealthy investors do both:

- Bitcoin for high-growth wealth building

- Real estate for stability & passive income

7. Future Outlook (2025-2030)

Bitcoin Prediction

- $100,000+ likely by 2025 (halving effect)

- Mass adoption as “digital gold”

Real Estate Prediction

- Slow 3-5% yearly growth (historically)

- AI & remote work changing demand

🚀 Growth Winner? Bitcoin (but real estate won’t disappear).

Conclusion: Should You Buy Bitcoin or Real Estate?

Final Verdict:

| Goal | Best Investment |

|---|---|

| Fast wealth growth | Bitcoin |

| Stable passive income | Real estate |

| Diversification | Both! |

💡 Pro Tip: If you’re under 40, lean Bitcoin. If retired, lean real estate.

FAQs

1. Can Bitcoin replace real estate?

- No, but it’s a better growth asset.

2. Is real estate safer than Bitcoin?

- Short-term, yes. Long-term, Bitcoin has higher upside.

3. How much Bitcoin should I buy vs. real estate?

- Young investors: 70% crypto, 30% real estate

- Pre-retirement: 30% crypto, 70% real estate

4. What if I can’t afford real estate?

- Start with Bitcoin (lower entry cost).

5. Which makes more millionaires?

- Recently, Bitcoin (but real estate still dominates wealth).

Ready to invest? The best time to start was yesterday—next best is today! 🚀